Konect have collaborated with numerous fuel retailers to secure millions in funding, boasting a c68% win rate.

Successfully securing grants or funding can significantly shorten the time taken for EV chargers to become cash positive for operators. To help illustrate that point, we’ve explored two funding methods to show the impact on a fuel retailers payback period.

The scenario

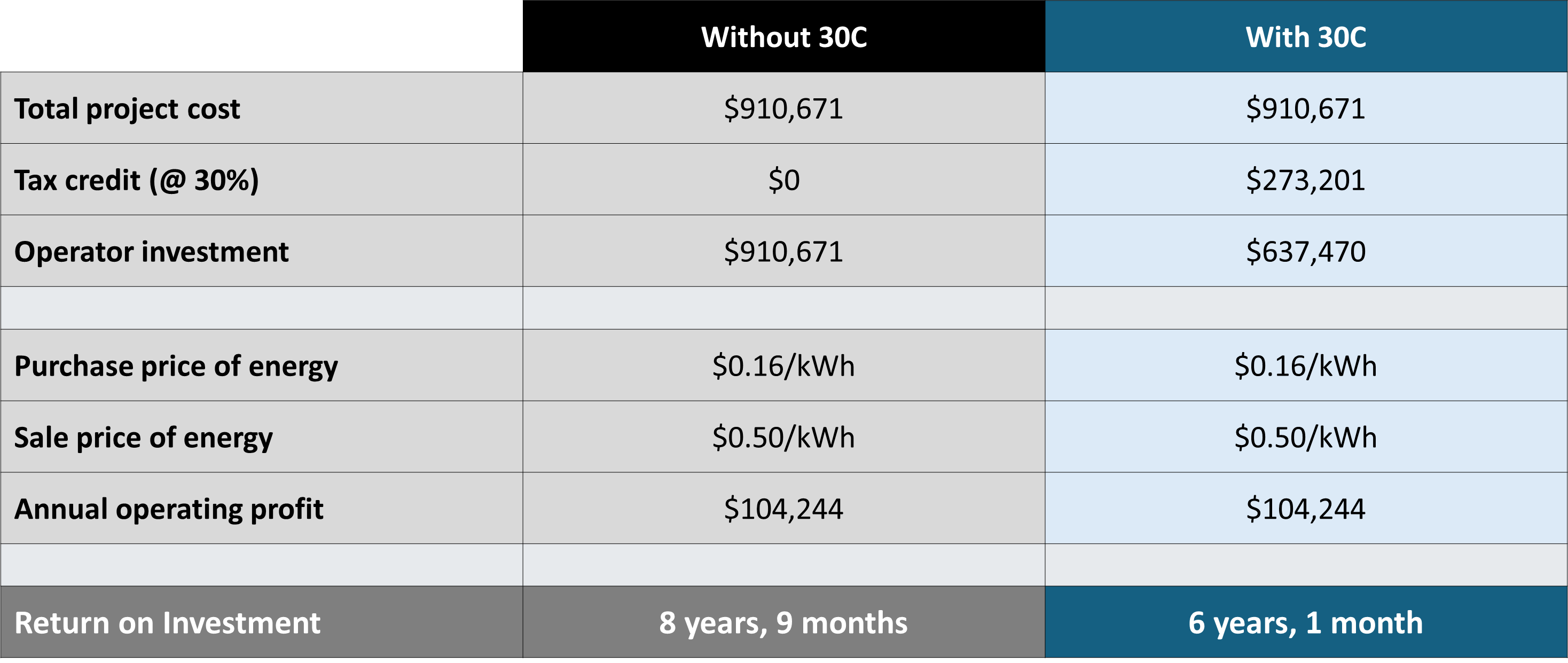

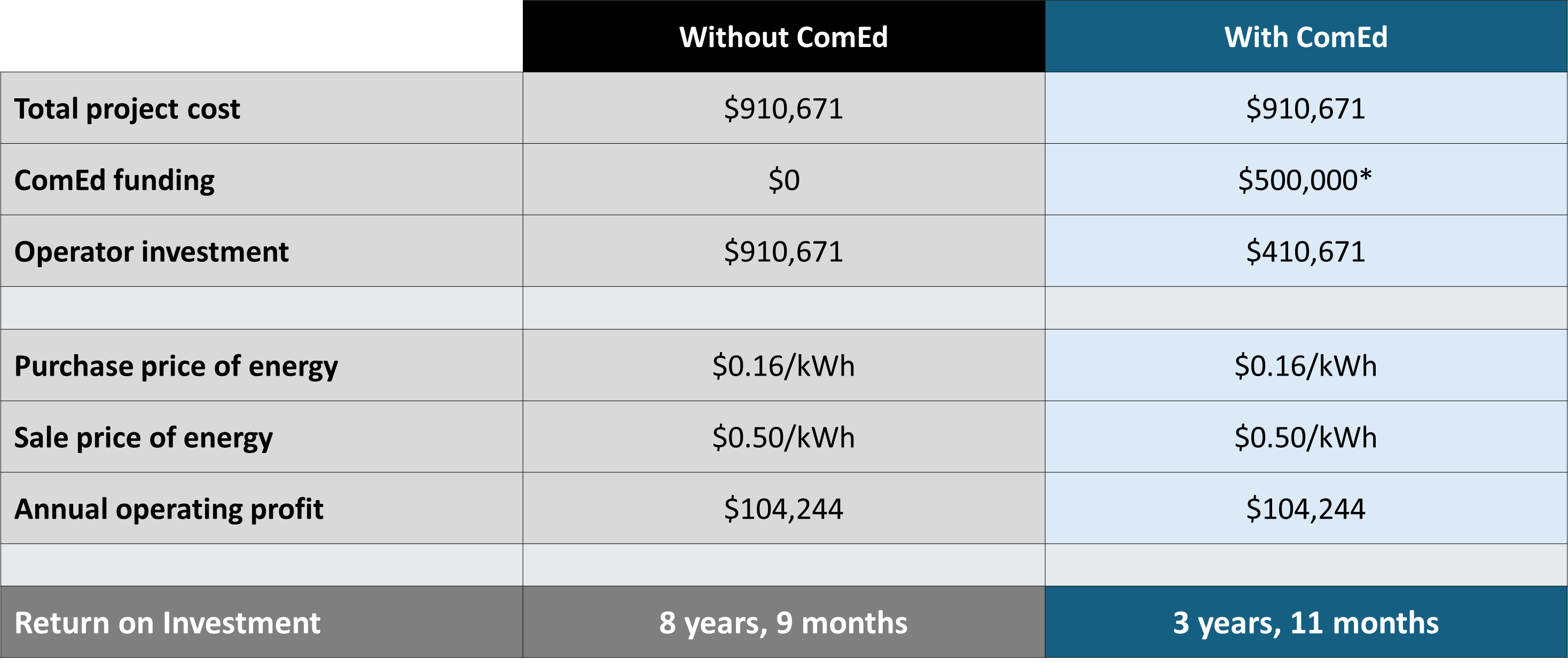

The figures below show comparative payback periods, with and without funding, for a typical c-store site with four 150kW chargers and a 30% utilization rate.

1. 30C Tax Credits

The federal 30C Alternative Fuel Vehicle Refueling Property Credit, provides a 30%* tax credit toward total costs for alternative fuel and charging infrastructure projects.

*The maximum credit is $100,000 per charging port for commercial installations.

For this site, return on investment would be almost a third (30.5%) faster with 30C incentive. (Depreciation and changes in utilization or pricing are not included within the calculation).

2. ComEd Commercial Charging

Chicago based utility provider ComEd offers rebates for businesses and public sector entities in its service area to support charging infrastructure installations, with a focus on DC fast chargers.

For this site, return on investment would be 45% faster with ComEd funding.

(Depreciation and changes in utilization or pricing are not included within the calculation).

There’s more!

ComEd can also be combined with 30C Tax Credits, which would make the ROI for this particular project even faster.

Konect can help future-proof your forecourt with funding

Although we’ve provided just two scenarios here, there are a variety of grants, funding opportunities, and incentives available for fuel retailers to set up EV charging stations and enhance their forecourt for the future.

If you're interested in learning how grants and funding can enhance your payback period for EV chargers, please reach out to us.