Do you know about the tax credit that applies to E85 fuel?

Here's what you need to know to take advantage.

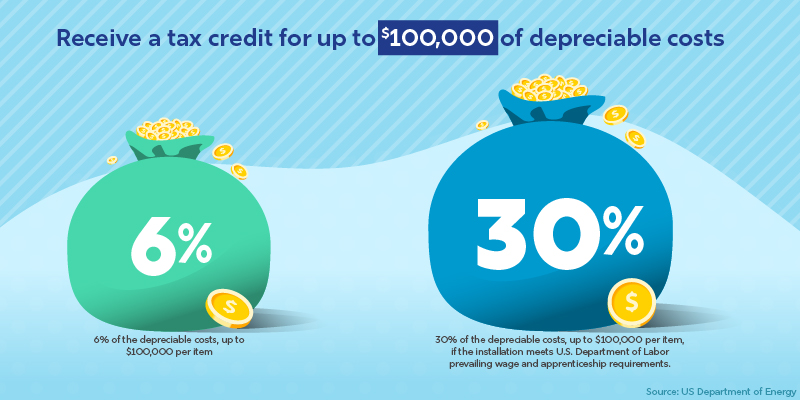

The Alternative Fuel Vehicle Refueling Property Credit is available for qualified fueling property installed in qualified locations on or after January 1, 2023, and through December 31, 2032. Eligible property includes certain fueling equipment for E85. Businesses are eligible for a tax credit of:

- 6% of the depreciable costs, up to $100,000 per item; or,

- 30% of the depreciable costs, up to $100,000 per item, if the installation meets U.S. Department of Labor prevailing wage and apprenticeship requirements.

Looking to Offer E85 at Your Site?

Want to offer E85, but don't have room on your grade selects? Look no further than the Encore 700 S dispensers. This line of dispensers offers 6-Grade Select, ensuring retailers’ fuel dispensers are flexible and ready for the future. 6-Grade allows you to sell the 4 “traditional” grades of Low, Mid, Hi Octane gasoline (E10) and Diesel while still having room to incorporate options like E85.

Upgrading to a 6-Grade Select dispenser lets your site offer more and can help you qualify for the credit above.

For more information, visit the Encore 700 S dispensers product page or contact your local Gilbarco Veeder-Root distributor.